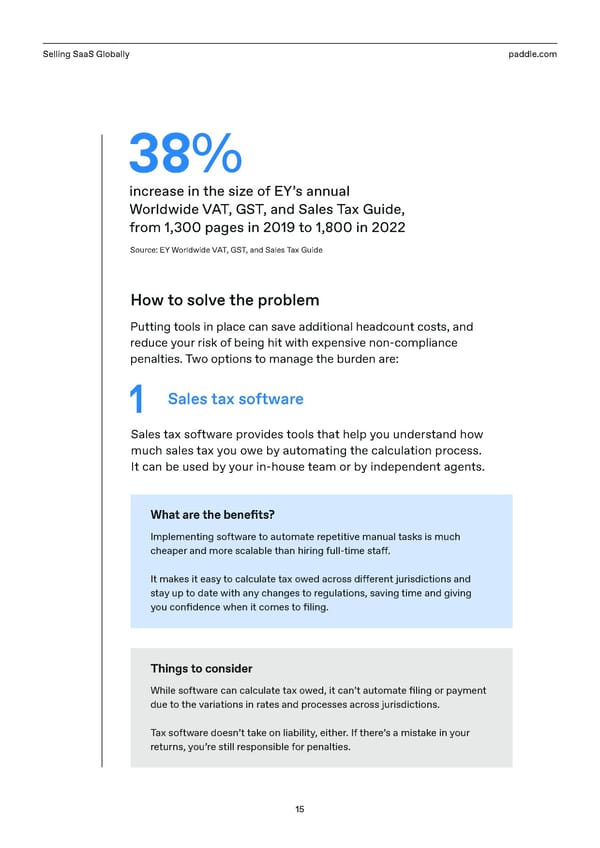

Selling SaaS Globally paddle.com 38% increase in the size of EY’s annual Worldwide VAT, GST, and Sales Tax Guide, from 1,300 pages in 2019 to 1,800 in 2022 Source: EY Worldwide VAT, GST, and Sales Tax Guide How to solve the problem Putting tools in place can save additional headcount costs, and reduce your risk of being hit with expensive non-compliance penalties. Two options to manage the burden are: 1 Sales tax software Sales tax software provides tools that help you understand how much sales tax you owe by automating the calculation process. It can be used by your in-house team or by independent agents. What are the bene昀椀ts? Implementing software to automate repetitive manual tasks is much cheaper and more scalable than hiring full-time sta昀昀. It makes it easy to calculate tax owed across di昀昀erent jurisdictions and stay up to date with any changes to regulations, saving time and giving you con昀椀dence when it comes to 昀椀ling. Things to consider While software can calculate tax owed, it can’t automate 昀椀ling or payment due to the variations in rates and processes across jurisdictions. Tax software doesn’t take on liability, either. If there’s a mistake in your returns, you’re still responsible for penalties. 15

Selling SaaS Globally | Handbook Page 14 Page 16

Selling SaaS Globally | Handbook Page 14 Page 16