One of the most powerful yet overlooked growth levers in SaaS is pricing strategy. Get it right and your revenue can soar. To do so, you need a handle on your target market's willingness to pay.

What is a go-to-market (G2M) strategy?

A go-to-market strategy is a plan for how to launch a new product or service in-market or launch an existing product in a new market. As such, go-to-market strategies tend to focus on the short-term, but effective ones will also consider how any immediate success can be sustained over a longer period.

There is no standard format for a go-to-market strategy. Different companies will need to consider and prioritize different elements, depending on their maturity, their existing presence in the market, their business model, how they are organized and financed, and any exit plans they may have.

Who needs a go-to-market strategy, and when?

Any project that aims to attract new customers needs a go-to-market strategy. Some of the obvious scenarios include:

- A startup launching their first product

- An established company launching a new offering

- The relaunch of a product that has been innovated to attract new users

- Building on the early success of a product with a stronger growth trajectory

Even companies and products that consider themselves settled can benefit from regular go-to-market strategy reviews, as a way to be aware and prepare for new competition and other market forces. So should your business have one? Absolutely.

How does a go-to-market strategy deliver growth?

It is possible to succeed without a go-to-market strategy, but for that to happen you need a once-in-a-generation product or a huge amount of luck. A good go-to-market strategy is designed to mitigate risk and maximize return on investment (ROI) by gathering knowledge before the event and using those insights to make the most effective action.

Let’s consider how this works.

Company A and Company B have new software products of equal capabilities. Company A opens for business first, without a go-to-market strategy. It may get some lucky early sales, but soon new customers dry up. It doesn’t know where to go to get new customers, or indeed what type of people they should be talking to, or what to say even if they find them. They try to cover all bases but find their marketing budget is spread too thin and their advertising messages don’t cut through. They quickly become drowned out by the competition. Meanwhile, the customers they did get are becoming increasingly frustrated at the lack of support and eventually go elsewhere.

Meanwhile, Company B has produced a detailed go-to-market strategy before it’s even taken a dollar in sales. Their marketing budget is concentrated in just a few countries that they have calculated are most profitable, and its advertising has been designed to resonate with a specific professional group. They have also taken the time to build a buying process that is not only easy to follow but incentivizes new customers to scale their use of the product. And by tracking some key user and financial metrics, they are able to predict with authority how they will grow, and thus the extra resources they will need to enable this future growth.

Company B wins every time. This is the value that a go-to-market strategy delivers.

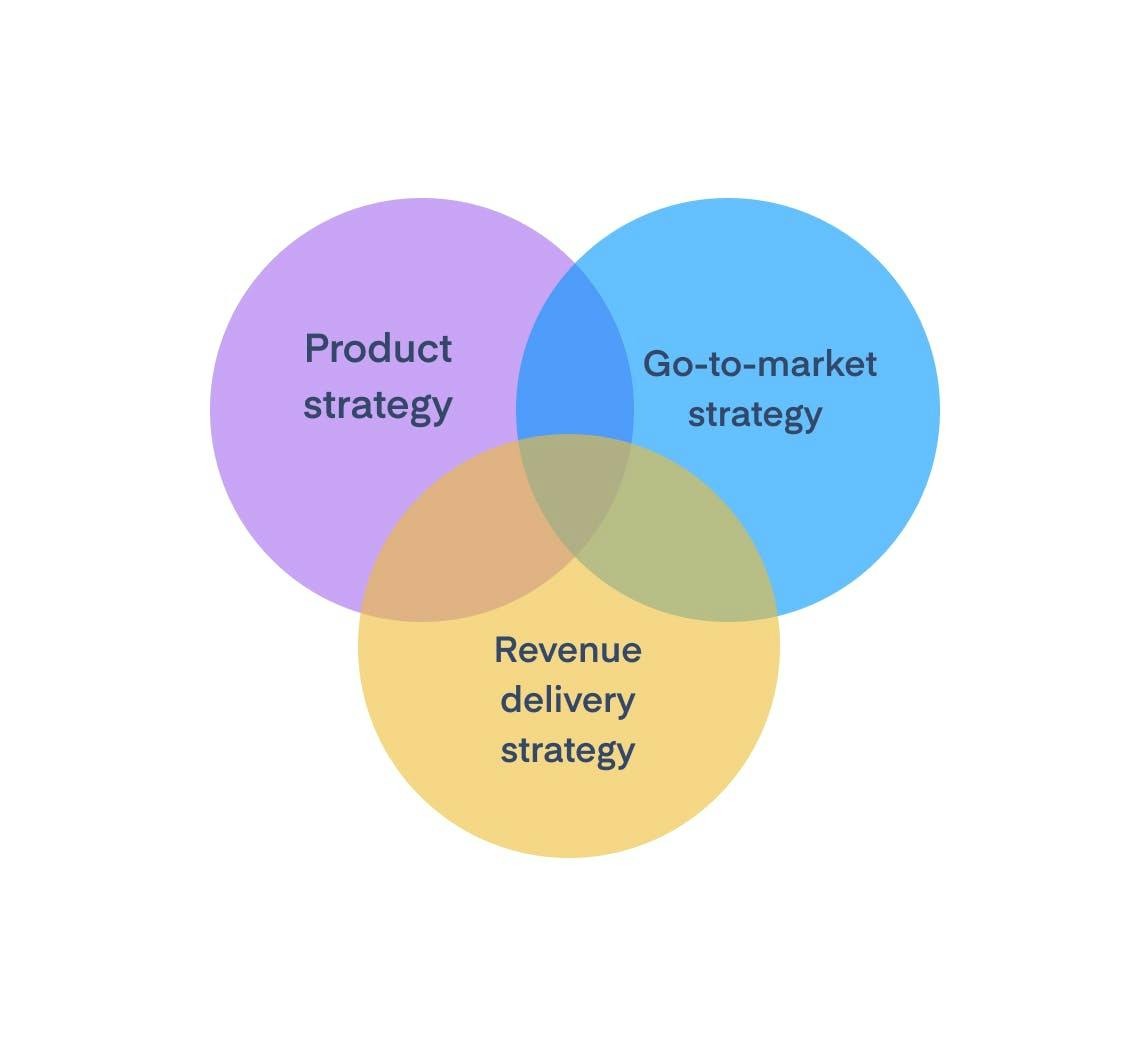

But a go-to-market strategy is not enough by itself. Go-to-market is one of three strategies that are needed for growth; with a product strategy and revenue delivery strategy being the other two.

A product strategy should clearly define the challenges that the solution aims to overcome, who benefits, and how those benefits are realized (e.g. in cost savings, time savings, higher performance, or improved security). The product strategy should also compare the capabilities of the product to similar solutions in the marketplace, and articulate how it is better, and where it falls short.

A revenue delivery strategy explains how the operational elements that are needed to support a product’s growth will be organized. A revenue delivery strategy is broad, covering how orders are taken and processed, how customer records are maintained, how users are onboarded, supported, billed, and upsold to, and what’s required to stay on the right side of financial and legal regulations.

The three pillars of growth

- Product strategy - explains the value the product brings and to whom.

- Go-to-market strategy - finds and persuades the people most likely to benefit.

- Revenue operations strategy - defines the processes and tools needed to commercialize the product.

Product launch strategy: How to launch a new product in 5 Steps

What types of go-to-market strategies are there?

So, the best products (resulting from the product strategy) will fail without customers (delivered by the go-to-market strategy); and the best products, with lots of customers, will fail if sales can’t be processed and service levels sustained (step forward the revenue delivery strategy).

But not every go-to-market strategy slots neatly into the middle of this journey. How you approach your go-to-market strategy depends on what will be driving your growth. In simple terms, there are two options: growth that is product-led; and growth that is sales-led.

A product-led go-to-market strategy

A product-led go-to-market strategy puts the product at the heart of growth. The product is not only a solution to a business problem but also serves as a silent salesperson by letting customers buy, renew, and upgrade all without leaving the product. Key to the concept of this self-serve sales model is not just the absence of a salesperson at the moment of purchase, but also in the discovery and research phase of the sales journey. In theory, everything a potential customer wants to know - from the features and technical requirements of the solution to the pricing options and contract terms - should be available within the product.

Product-led go-to-market strategies are a volume play, with tactics such as a freemium offer designed to attract users first, before turning them into paying customers later.

In product-led go-to-market strategies, the product is the core sales channel, and so the distinction between product strategy and go-to-market strategy becomes more blurred. Elements such as site architecture, product design, UX and copy all determine the customer journey, and so become more important to the go-to-market strategist.

A sales-led go-to-market strategy

A sales-led go-to-market strategy sees sales initiated and closed by a salesperson. Though the product will be a key part of any sales conversation, the sale itself (and any future renewals and upgrades) takes place away from the platform. This tends to be the approach taken when the product is so revolutionary, or complex, or expensive that the buying decision involves many stakeholders and many engagements, over a number of months. The sales process is resource-intensive, and in turn, the business will focus on achieving fewer sales at higher margins.

Because sales-led go-to-market strategies are directed by people, the product plays less of a role, and therefore the ongoing link with product marketing is weaker. Instead, in a sales-led growth plan, product marketing, and go-to-market strategies will work closely at the start to define the benefits of the solution and the target audience. Equally, in a sales-led go-to-market strategy, where the product is not the vehicle for processing orders, product and revenue delivery strategies are more detached.

SaaS Sales playbook: Processes, models, metrics & careers

How to build your go-to-market strategy

Whether you’re launching a new startup or a new product; and regardless of whether you’re following a product-led or sales-led path to growth, a good go-to-market strategy includes certain core elements. Here we look at four of the main components you should consider when creating a go-to-market strategy.

- Target market: Who is going to benefit most from what we offer, where are they (geographically and in terms of sector), what else can we find out about what they have in common, and is anyone else likely to be involved in the buying decision?

- Product market fit: What are the specific pains that we are helping to overcome, how do we do that differently (and better) than the competition, and how do we communicate that in a way that resonates?

- Pricing strategy: How much money is someone likely to pay for what we do (if at all), how does that mentality change if we offer more capabilities, and what method of payment and consumption will make them more inclined to buy and keep buying?

- Distribution and adoption plan: What channels and formats are the best to reach our target customers, what help and how long might they need before committing to a purchase, and what support do they need to maximize their investment with us?

As we saw with the relationship between go-to-market, product and revenue strategies, these elements are not linear. There are interdependencies, meaning the answer to one question will inform (or invalidate) another. That said, every go-to-market strategy needs to start somewhere. This will often be driven by the history or culture of a business.

An effective go-to-market strategy should be continually reviewed, and if necessary adapted, to ensure success

Startups whose founders set out to fix a problem that frustrated them will likely begin with the product-market fit and engineer a business case around that; whereas an enterprise vendor with the means to innovate quickly may be driven by what their customers are telling them they need. Equally, an opportunistic entrepreneur may conclude that every product in a range is overpriced or suffering from poor customer service and set out to remedy that.

Where you start with your go-to-market strategy is not as important as ensuring you focus on all four elements in parallel. This will ensure your final go-to-market strategy is holistic, thorough, and consistent.

1. Define the target market

Markets can be defined in different ways, and each needs to be considered in a go-to-market strategy. Markets can be a specific sector, a profession, a demographic, or a physical place. Sometimes, these need little thought. A software platform for managing employees will clearly need to target HR professionals. An app that provides public transport schedules for Japan is unlikely to find much success in any other country. But sometimes there is more than one target. For example, a user of your product may not be the person who decides to buy it; and there may also be a separate person who needs to sign off the budget.

Making things more tricky still is the different way that businesses are structured and make decisions. In one business, you only need to persuade a single middle manager, whereas in another may require more senior approval. If your product is software or other technology, then it’s likely that the prospect’s IT and security people will want a say to ensure it can integrate with their other systems. There may also be influencers - both inside and external to the prospect - whose words wield power. The key is to build personas for every possible target that helps move the strategy from the abstract, closer to reality.

The same applies to selecting your market segment. Products that have been designed for a specific vertical - think compliance software for banks or safety equipment for construction firms - need only worry about a specific sector. But for a product with a multi-sector appeal, (i.e. because it supports a general business function, such as finance, HR, or CRM) the plan becomes more complicated.

It may be uneconomical to go after every target persona and market segment straight away. A good place to start is to understand the Total Addressable Market (TAM) and the value of each subsect of that - be it a specific sector, demographic, or country. The go-to-market strategy should prioritize which targets to go for first, and when to push the button on the others. Alongside the size of a market, other criteria that can be used for this prioritization include the existence of competitors, speed of decision making, cost of acquisition, number of potential users, expected lifetime value, or a buyer’s influence in the marketplace.

Example: Vuclip, a video buffering service, focused on the “must-have” market and not “nice to have” markets. Having analyzed failed ventures in this category, Vuclip decided against targeting enterprise businesses and instead went after mobile consumers in Africa, where mobile usage is high but network performance is poor. Read their story.

2. Make your product fit your market

Though it’s the job of the product strategy to explain the value the product brings and to whom, the go-to-market strategy goes deeper, explaining how to communicate these benefits in each market being targeted.

A product-market fit should consider two elements - what customer pains are being addressed, and what outcomes can be expected. This is often called a ‘value proposition’, and it ensures prospects and customers hear a consistent message. For complex products, where there are multiple targets involved in the buying journey, different value propositions should be created for each group or market.

Though a value proposition will be adopted in external marketing and advertising messaging, it begins life as an internal document; and how that is created and visualized is key to its effectiveness. It is common for value propositions to be devised with a matrix, where some measure of business outcome (i.e value) is set against some measure of input (i.e cost, complexity of deployment, ease of use).

Plotting a product on this grid is helpful to visualize its comparative strengths and weaknesses, and more so if you do the same for competitors. The grid is typically split into quadrants, to understand who are the closest competitors based on the product-market fit, and which products are likely targeting a different audience (or the same audience, but with a different business case) and so can be deprioritized.

The best go-to-market strategies will go a step further, and articulate ‘attack’ and ‘defense’ positions against each close competitor identified in the value matrix. Often these become fully formed scripts that can be lifted straight into customer pitches and conversations.

Example: Monday.com, a CRM platform, doesn’t leave product-market fit as a behind-the-scenes research project. From the homepage of its website, prospects are able to direct their journey according to the pain they are facing. And not only that - Monday.com also serves up a quick comparison of its platform versus the leading competition.

3. Set the right prices and packages

One of the key make-or-break factors of any new product launch is the price. A great product can be snubbed by customers if over-priced, but if underpriced you could be unnecessarily leaving revenue on the table.

The work done so far on defining your target customer personas and your product-market fit will give you a clear indication of the right bracket to set your price in. Indeed, your research may have uncovered a lack of willingness on behalf of your target customers to pay for the solution you are offering. If so, you may conclude that the product in its current state does not have enough market potential; or you may decide to launch as a free service, with a view to selling higher value product extensions and services later.

As well as cost, a pricing strategy should define how a customer will want to pay. This is partly around consumption - for example, does your target value the flexibility of a monthly subscription, or could they be persuaded to purchase a potentially more lucrative multi-year licence? It is also about cost criteria - in other words, do you charge based on how much (or little) of the service is used, how many users a customer has, or a set price determined by a customer’s perception of the value you bring, and your negotiations skills.

Understanding payment method preference is also important, and very dependent on the market(s) you are targeting. For example, in the US paper checks are still a common way for people and businesses to pay, whereas in Western Europe cards and bank-to-bank payment methods like direct debit are far more popular. And around the world, payment preference is increasingly defined by localized schemes and alternative payment methods (APMs).

Example: HubSpot employs a tiered pricing strategy, designed around the specific needs (and budget) of different customer targets, and as well as offering a free introduction package, it also promotes packages that bundle a range of services together for ease of purchase.

4. Reach (and keep) customers

The final part of an effective go-to-market strategy should take the prospect journey all the way through to sales closure, adoption, and future upgrades and renewals. The core of this phase is the sales and marketing plan, which considers the best channels to reach prospects with the value proposition.

Today, there is an almost unlimited choice of channels - from traditional media and PR, TV and radio, to digital advertising and social media influencers. For some sectors, selling through partners and resellers who are established in a market can be a traditionally effective way of achieving cut-through. The aim of the plan is to predict which channels will produce the best ROI. Depending on the other elements of the go-to-market strategy, ROI may be defined by the volume of customers, cost-per-sale, customer lifetime value, or a combination of these and other KPIs.

What happens to a new customer is equally important. A go-to-market strategy should be clear about the level of customer support that needs to be achieved to sustain growth. For example, high-value customers with complex deployments and hundreds of users may expect a dedicated account and support team; whereas that level of resourcing is unlikely to make commercial sense for a self-service customer. That said, well-designed onboarding and a localized response (i.e. that lets a customer communicate in their language and timezone) are important to their happiness, and propensity to upgrade and renew in the future.

Example: Dropbox employed a simple customer referral program as a new sales channel, to go from 4 million to 500 million users in just 7 years. In exchange for a successful referral, customers would receive free storage. Key was embedding the referral program within the onboarding journey to build interest when customers were at their most engaged and excited. The referral program is still running today.

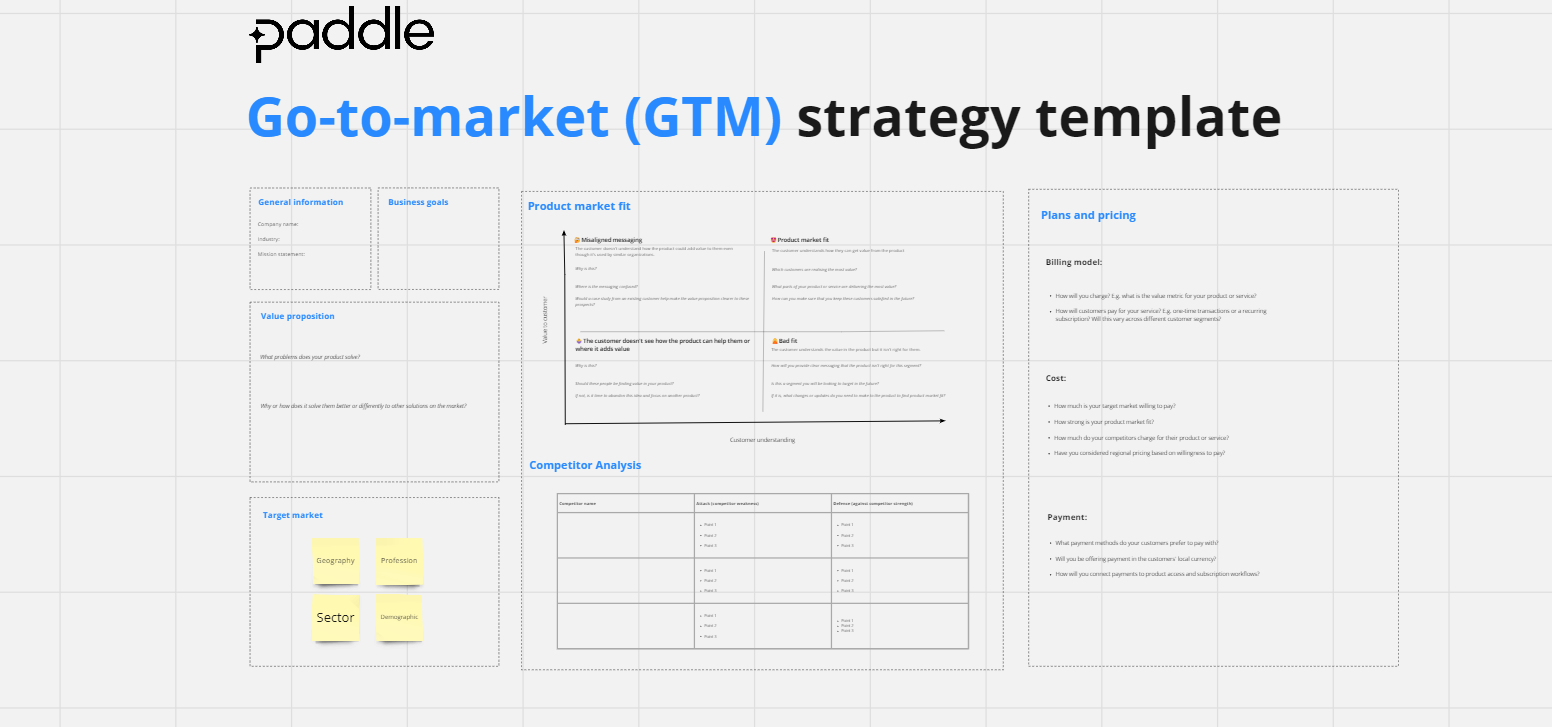

The best go-to-market strategies address all four of these elements in parallel. There's a lot to it, so we've built a template to help you get started.

How to measure the success of your go-to-market strategy

An effective go-to-market strategy should be continually reviewed, and if necessary adapted, to ensure success. To do this, it must include meaningful and measurable KPIs that track both short-term (even real-time) performance and long-term sustainable growth indicators. How many KPIs you track will be dependent, in part, on your ability to gather the data and report on it. Modern data analysis platforms have allowed businesses to get a more accurate and granular reading of success than ever before. That said, limiting yourself to KPIs that can help drive decision-making is more effective than drowning in numbers - what is known as ‘analysis paralysis’.

Many go-to-market strategies will visualize progress in terms of a funnel. At the top of the funnel are all the target customers that have been identified, and at the bottom are those who progress to become a customer. By dividing the funnel into various sections, you can measure the success of each step of the acquisition journey, to understand what is working, and what elements need refining. If you’re running a subscription model, you’ll need to extend that funnel to measure factors like churn, lifetime revenue, and recurring revenue.

There are limitless KPIs for a go-to-market strategy. Here are just some examples:

Operational

For product-led growth strategies, where the website is the core sales tool, measuring engagement on the site is fundamental:

- Visits - how many visitors are you attracting, what are they looking at, and where are they?

- Click-throughs - are they simply reading your content, or are they taking action (e.g. requesting information, submitting a contact form)?

- Touchpoints - how often does a prospect visit you (and what are they looking at) before they buy?

For sales-led growth strategies, where a salesperson initiates and closes a sales:

- Outbound calls - how many conversations is a salesperson having every day, who are they speaking with, and how many of these are second, third, fourth...time calls?

- Average conversion time - how long does it take a salesperson to convert a prospect into a customer?

Customer support - how many calls or support tickets are successfully dealt with, both in absolute terms and as a percentage of all inquiries?

Financial

- Cost-per-acquisition - how much does it cost to convert a prospect into a customer, in general terms, and also split by channel, location, customer persona or other criteria?

- Average revenue-per-customer - how much money is each customer bringing in, again divided to determine the best performing categories?

- Cash burn rate - how much money is being spent overall to keep the company (or specifically the product) in business, with a projected cash flow for up to two years?

Subscriptions

- Churn - what percentage of customers are you losing over a given period of time?

- Average and recurring revenue - average revenue is how much each customer is buying over a given period, with recurring revenue being that number rolled up across your entire business?

- Net revenue retention - takes into account customer upgrades, downgrades, and churn to show (as a percentage) how much your business could continue to grow from your current customer base alone.

Brand

- Customer review scores - independent third parties (e.g. Trustpilot, Google, Rated People, Feefo) that aggregate customer and user feedback.

- Brand tracker surveys - it is common for businesses to survey customers and the wider market to understand brand awareness, sentiment, and competitor strengths.

- Share of conversation - tools can aggregate activity from multiple social platforms and digital communities to understand how dominant (or not) their voice is in a particular conversation, term, or group.

Three real-life examples of go-to-market strategies

Kaleido

In December 2018, Kaleido launched a tool to automatically remove backgrounds from images called remove.bg. By offering the tool freely, Kaleido captured media attention and millions of users tried their product. They also offered a scaling monthly subscription plan and a pay-as-you-go model.

In partnership with Paddle, they launched in 20 countries, and have made currency optimization a core KPI. 18 months later they have 43,000 customers across 181 countries. Subscriptions are now their fastest-growing revenue segment.

Mailchimp

Mailchimp, an email automation tool, began by only targeting small businesses and individual users. They offered a free service to lure prospects with limited budgets and created buzz through SEO, PR, and word-of-mouth marketing. To keep costs low and acquisition easy, they adopted a product-led strategy that put their platform at the heart of their new sales operation.

After growing steadily for a few years, they reviewed their pricing strategy and introduced paid-for subscription packages based on enhanced features, third-party integrations, and volume.

Acorio

Acorio, an established partner of SaaS vendor ServiceNow, strengthened its market position with a go-to-market strategy that used research and data to reinforce its credentials. These insights were divided up according to relevance to key decision-makers and used to create targeted content - including reports, articles, and presentations.

Ready to build a killer go-to-market strategy?

Check out the Paddle go-to-market strategy template, and get started on yours today.